Predictions, Sports-Betting, and the Real Game of Wealth

Every December, the big Wall Street firms dust off their crystal balls and announce their predictions and forecasts for the year ahead. Goldman Sachs recently revamped its target for 2026, revising expectations for where the S&P 500 is headed next. It makes for great headlines — and even better entertainment — but as every seasoned investor knows, the market has a way of humbling even the smartest predictions.

Consider 2024…

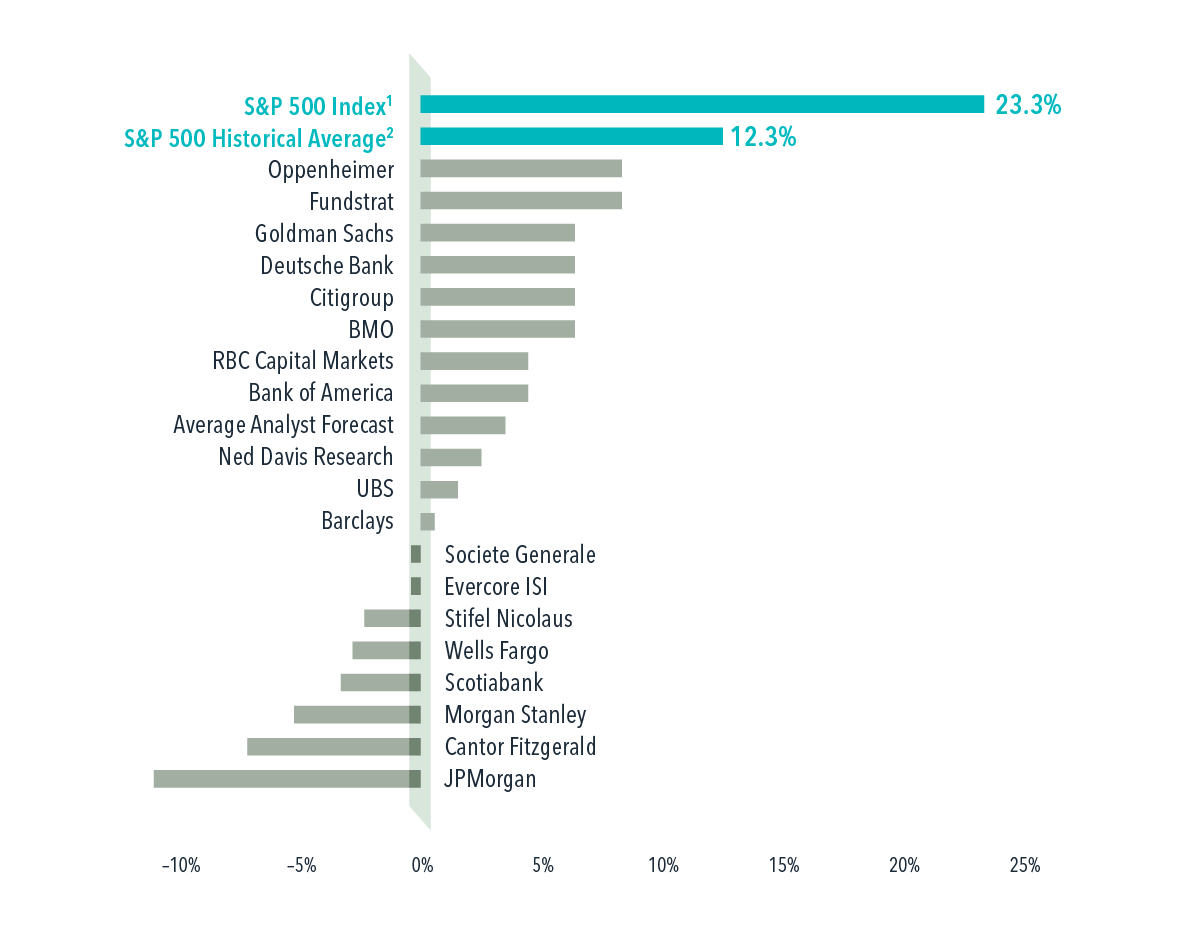

The average analyst forecast called for the S&P 500 to rise about 12%. The actual return? 23.3%.

In fact, some of the largest banks — JPMorgan, Morgan Stanley, and Cantor Fitzgerald — predicted negative returns (see chart below). Those forecasts weren’t careless; they were simply overwhelmed by what evidence-based research tells us time and again: markets are smarter than any one opinion.

Equity analyst predictions vs. actual for the S&P 500 Index calendar year return in 2024 (per Dimensional Fund Advisors)

The Myth of Prediction

Each firm’s “target” is an attempt to distill millions of daily transactions, global economic forces, and human emotions into a single number. It’s a noble effort, but a fool’s errand.

As academic research has shown, the stock market is a real-time information processor. Every time an investor buys or sells, prices adjust to reflect the collective wisdom and expectations of millions of participants. This constant tug-of-war drives markets toward equilibrium — the balance point where buyers and sellers agree on value.

Trying to consistently “beat” this equilibrium is not impossible, but it is highly improbable. Prices already reflect what’s known and widely expected. By the time you’ve spotted a “great company,” the rest of the world has too, and the opportunity has already been priced in.

A Sports-Betting Analogy

Think about sports betting. When an undefeated team faces a winless one, the only way to attract bets on the underdog is to move the point spread until both sides feel fair. In 2013, the Denver Broncos were 28-point favorites over the Jacksonville Jaguars. They won — but only by 16. The Jags were the better bet.

Once the spread adjusts, the outcome becomes roughly a coin flip — not a test of skill.

The same logic applies to markets: when prices are fair, outguessing them isn’t about brilliance; it’s about luck.

The Rise (and Rotation) of the Magnificent 7

Today’s investors are enamored with the Magnificent 7 — Apple, Amazon, Alphabet, Meta, Microsoft, NVIDIA, and Tesla. They dominate market capitalization, headlines, and portfolios alike. But history offers a humbling reminder: it’s hard to stay on top.

According to research from Dimensional Fund Advisors, only three of the 10 largest U.S. companies in 1980 were still on that list by 2000 — and none remain in the Top 10 today.

Back then, six of the top companies were in the energy sector. By 2000, telecom and finance had taken over. In 2025, it’s technology.

Industries ebb and flow, leadership rotates, and innovation spreads across sectors. New technology doesn’t just reward tech firms — it transforms all businesses that adapt and evolve. That’s why diversification, not concentration, remains the surest way to share in today’s success stories and tomorrow’s.

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. The Magnificent 7 stocks are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. Named securities may be held in accounts managed by Dimensional. Source: Dimensional, using data from the Center for Research in Security Prices and Compustat. Includes all US common stocks. Largest stocks identified at the end of the calendar year preceding the respective period

by sorting eligible US stocks on market capitalization using data provided by the CRSP, University of Chicago.So What Should You Do Instead?

Stop treating the market like a prediction game. Instead, treat it like a wealth-preservation machine — a place to compound quietly, not gamble loudly.

The real engines of wealth come from two enduring sources:

Translating your skills into big-time income. Whether on the field, in business, or through your craft, the most powerful wealth-building tool is your ability to create value (then invest that income in durable assets).

Building or scaling a business that produces strong cash flow and/or a valuable exit.

Yes, private equity and venture capital can deliver outsized returns, but they’re entirely different games — higher risk, less control, and more variance. Play them if you choose, but know which game you’re playing.

The Alignment Formula

Financial peace doesn’t come from prediction. It comes from alignment — controlling what you can, and letting evidence guide the rest.

Use your talent for creation, your investments for preservation, and your plan for freedom.

That’s the formula. And it works — whether you’re an athlete, an entrepreneur, or simply someone who wants to spend their life well.

DISCLOSURE: This content is provided for informational and educational purposes only and should not be construed as investment advice, an offer, or a solicitation to buy or sell any security. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal. Lighthouse Planning is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Lighthouse Planning and its representatives are properly licensed or exempt from licensure.